Walk into any conversation about the future of robotics, and chances are you’ll hear the same name: Optimus, Tesla’s humanoid robot designed to work, assist, and eventually coexist with humans. But a new player is already rewriting the script. Enter the R1 robot, the Chinese humanoid unveiled as a direct competitor to Optimus. To some, it signals a global race where artificial intelligence leaders like OpenAI push the intelligence, and countries like China deliver the scale. To others, it’s an early glimpse into how fast robots may transition from futuristic novelty into everyday workforce companions.

Table of Contents

Optimus: The Promise and the Problem

Tesla’s Optimus project is built on staggering ambition. Elon Musk once described it as more impactful than Tesla’s electric cars, predicting a machine so capable and affordable it could become “the future of labor.” Optimus showcases Tesla’s strengths—integrated actuators borrowed from EV engineering, multi-axis movement from robotics research, and critically, AI algorithms derived from the backbone of Tesla’s self-driving software.

Early prototypes were clumsy, but the 2024 iterations highlighted smoother walking and better precision. Videos showed the robot folding clothes, sorting blocks, and even pacing side-by-side with humans. Yet, those demos also reveal the challenge: Optimus is still slow, limited to controlled tasks, and far from general human replacement. The lingering problem is scale. Can Tesla mass-produce these robots the way it mass-produces cars? And can Optimus truly achieve the OpenAI-inspired cognition needed to handle unpredictable environments?

China’s Counter: The R1 Robot

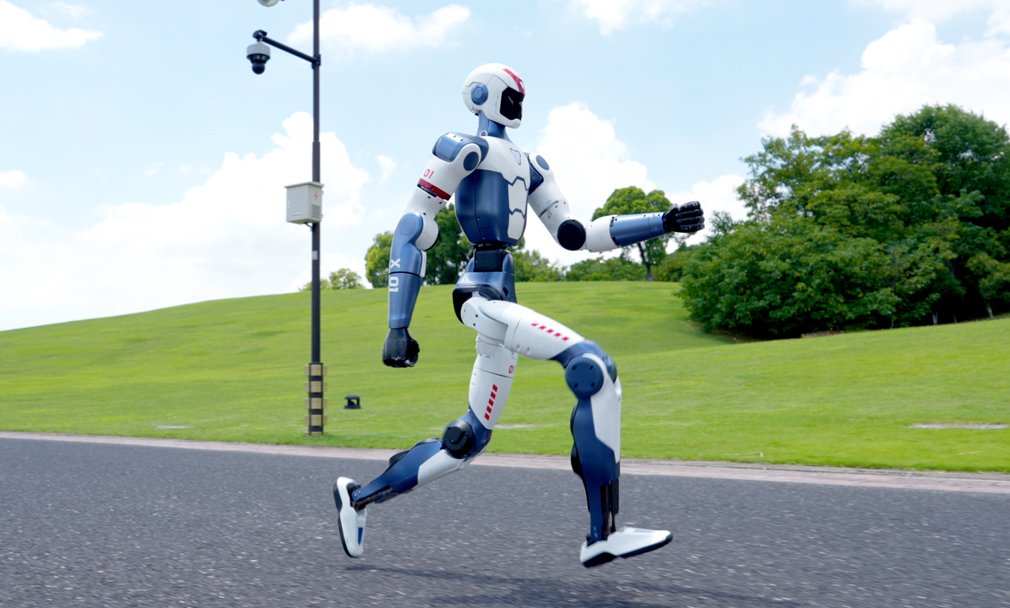

This is where the R1 robot enters the picture. Marketed as a Chinese robot rival to Optimus, the R1 has quickly gained attention for taking a more incremental, pragmatic path. While Optimus positions itself as a futuristic assistant, R1 presents itself as a tool for immediate needs.

In public demonstrations, R1 robot was shown balancing well on uneven surfaces, picking up packages, and completing warehouse-style work. Industry insiders note that China already operates the largest industrial robotics market in the world, with more than 50% of new global installations taking place inside its factories in 2023. This gives R1 a natural launching point: instead of trying to win global headlines, it could simply embed itself in thousands of Chinese factories that already rely on automation.

Read More: AI Hallucination: Erosion of trust in the Age of Generative Models

By building cheaper, lighter, energy-efficient robots, Chinese engineers are signaling their endgame: scale first, polish later. A parallel here can be drawn to the smartphone industry. The first iPhones showcased design brilliance, but Chinese manufacturers like Xiaomi and Huawei ultimately democratized the technology worldwide by making it accessible, even if their first devices weren’t revolutionary.

Optimus OpenAI vs. R1 AI

Where Optimus really banks its future is AI. Integrating OpenAI-inspired models is the key to moving from a remote-controlled machine to a semi-autonomous aid. Imagine Optimus not just performing physical tasks but also responding in natural language—“place that box carefully, then come back here.” That’s Musk’s vision: a robot you don’t need to program but simply talk to.

R1 robot, however, leans into China’s fast-growing AI network. Companies like Baidu and Huawei are developing their own large language models that rival Western standards. Combine that with China’s government-supported robotics push, and the R1 robot could soon train on massive datasets to fine-tune pattern recognition, object handling, and even human interaction in warehouses and homes.

For perspective, China allotted over $15 billion in funding for AI and robotics research in 2022–2024, with regional governments offering incentives for AI start-ups. This means the Chinese R1 robot may not just catch up to Optimus—it could, at least in sheer deployment, surpass it.

Everyday Examples That Show the Divide

To see the difference in approach, consider two scenarios:

- Factory logistics: Optimus is built to fold into a Western-style automation model, requiring advanced training, flexible adaptability, and deep AI control. R1 robot, by contrast, could be rolled out by the tens of thousands into assembly plants where repetitive tasks matter more than flawless interaction. If a robot can carry auto parts or package electronics, intelligence complexity becomes secondary.

- Home assistance: Optimus envisions itself as a robotic butler—helping with chores and even one day becoming a personal caregiver. R1 is unlikely to be in your living room immediately. But given China’s aging population, it’s realistic to see projects where thousands of R1 robot units help in retirement homes, providing basic lifting, movement support, or meal transport.

Read More: Canon EOS C50: The Creator’s New Hero

Why This Rivalry Feels Different

Unlike other tech rivalries, the Optimus vs. R1 battle isn’t about small conveniences like phone screens or app stores. It’s about labor, productivity, and even the structure of economies. Analysts predict the humanoid robotics market could exceed $150 billion by 2035, driven by demand for both premium robotics (where Optimus sits) and functional industrial units (the target space for R1).

If Optimus demonstrates what state-of-the-art humanoid AI can look like, then R1 demonstrates how quickly and cheaply humanoids can become part of the world economy. Both matter. Neither can be ignored.

Pingback: AI Hallucination: Erosion of trust in the Age of Generative Models - uniqnodes